Property tax bills are mailed each year on November 1 and are due March 31 each year.

The Tax Collector’s Office plays a key role in funding:

Property tax bills are mailed each year on November 1 and are due March 31 each year.

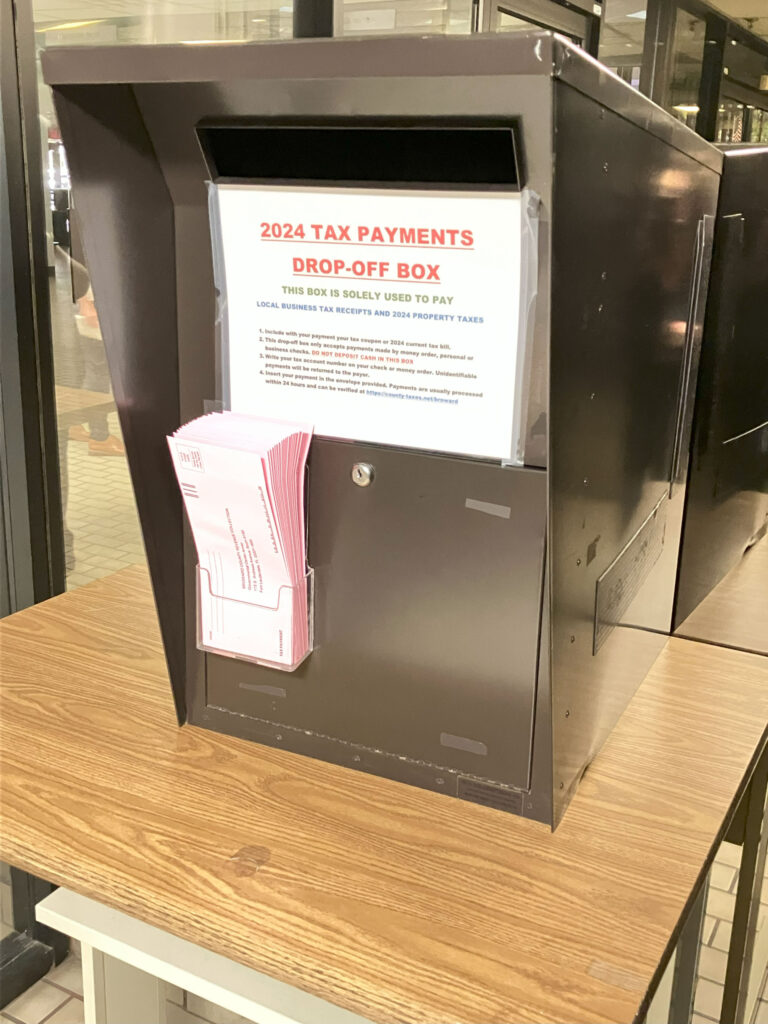

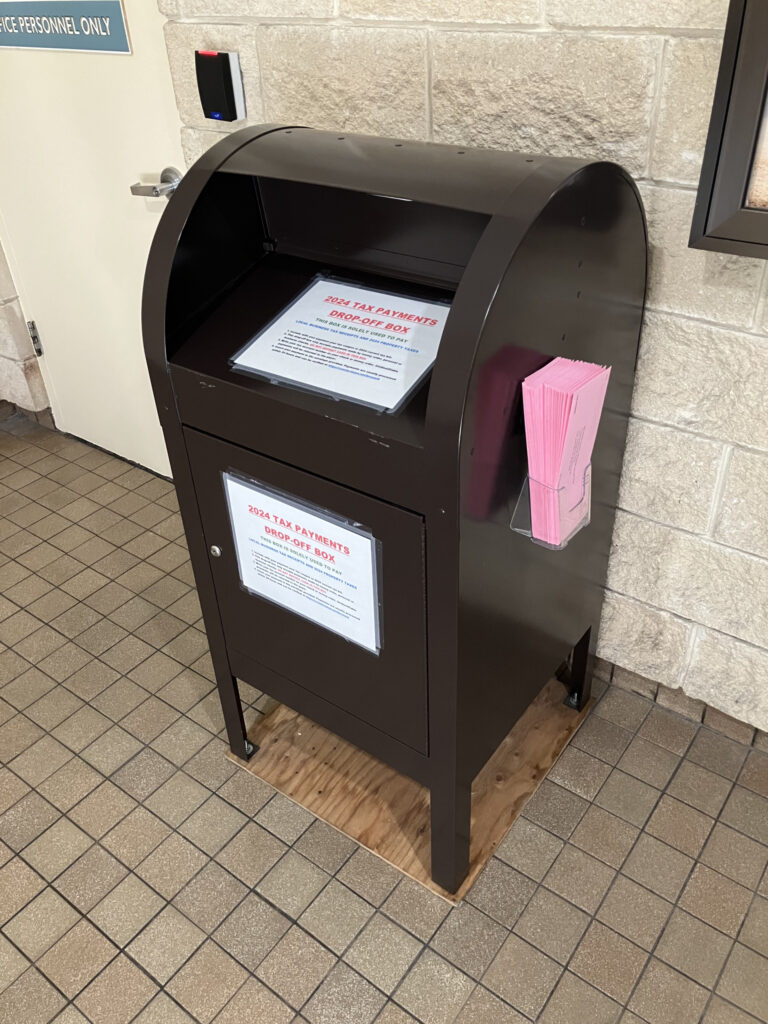

Click on the icons below to see what payment options are available for you:

Broward Constitutional Tax Collector

P.O. Box 105048

Atlanta, GA 30348-5048

Broward Constitutional Tax Collector

3585 Atlanta Avenue

Hapeville, GA 30354-1705

Broward Government Center

115 S Andrews Ave

Fort Lauderdale, FL 33301

Paid by June 30.

Taxes Discounted by 6%

Paid by September 30

Taxes Discounted 4.5%

Paid by December 31

Taxes Discounted 3%

Paid by March 31

No Discount

To enroll:

When you pay early on your property tax, you can save a percentage off your bill.

Save 4%

Save 3%

Save 2%

Save 1%

Taxes Due

Pay Now and Save

Taxes

115 S. Andrews Ave, A100

Fort Lauderdale, FL 33301

Motor Vehicle

1800 NW 66th Ave

Plantation, FL 33313

Monday – Friday

8:30 a.m. – 5:00 p.m.

© 2025 Broward Constitutional Tax Collector